PRE 14AFALSESYNCHRONY FINANCIAL000160171200016017122023-01-012023-12-310001601712syf:Mr.DoublesMember2023-01-012023-12-31iso4217:USD0001601712syf:Mr.DoublesMember2022-01-012022-12-3100016017122022-01-012022-12-310001601712syf:Mr.DoublesMember2021-01-012021-12-310001601712syf:Ms.KeaneMember2021-01-012021-12-3100016017122021-01-012021-12-310001601712syf:Ms.KeaneMember2020-01-012020-12-3100016017122020-01-012020-12-31000160171212023-01-012023-12-31000160171222023-01-012023-12-31000160171232023-01-012023-12-31000160171242023-01-012023-12-31000160171252023-01-012023-12-310001601712ecd:PeoMembersyf:DeductionsOfEquityAwardsMember2023-01-012023-12-310001601712ecd:PeoMembersyf:AdditionsAdjustmentsToSctTotalMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:DeductionsOfEquityAwardsMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:AdditionsAdjustmentsToSctTotalMember2023-01-012023-12-310001601712ecd:PeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearRsusMember2023-01-012023-12-310001601712ecd:PeoMembersyf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearRsusMember2023-01-012023-12-310001601712syf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedRsusMemberecd:PeoMember2023-01-012023-12-310001601712ecd:PeoMembersyf:AdditionsAdjustmentsToSctTotalRsusMember2023-01-012023-12-310001601712ecd:PeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearPsusMember2023-01-012023-12-310001601712ecd:PeoMembersyf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearPsusMember2023-01-012023-12-310001601712ecd:PeoMembersyf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedPsusMember2023-01-012023-12-310001601712syf:AdditionsAdjustmentsToSctTotalPsusMemberecd:PeoMember2023-01-012023-12-310001601712ecd:PeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearSosMember2023-01-012023-12-310001601712syf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearSosMemberecd:PeoMember2023-01-012023-12-310001601712ecd:PeoMembersyf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedSosMember2023-01-012023-12-310001601712ecd:PeoMembersyf:AdditionsAdjustmentsToSctTotalSosMember2023-01-012023-12-310001601712ecd:PeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearMember2023-01-012023-12-310001601712syf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearMemberecd:PeoMember2023-01-012023-12-310001601712ecd:PeoMembersyf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearRsusMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearRsusMember2023-01-012023-12-310001601712syf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedRsusMemberecd:NonPeoNeoMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:AdditionsAdjustmentsToSctTotalRsusMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearPsusMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearPsusMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedPsusMember2023-01-012023-12-310001601712syf:AdditionsAdjustmentsToSctTotalPsusMemberecd:NonPeoNeoMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearSosMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearSosMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedSosMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:AdditionsAdjustmentsToSctTotalSosMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:FairValueAtYeOfOutstandingUnvestedAwardsGrantedDuringApplicableYearMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:YearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedDuringApplicableYearMember2023-01-012023-12-310001601712ecd:NonPeoNeoMembersyf:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

________________________

| | | | | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant o |

Check the appropriate box:

| | | | | |

x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | | | | | | | | | | |

| | | |

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS Dear Stockholders: You are invited to attend Synchrony Financial’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 11, 2024 at 11:00 a.m., Eastern Time, for the following purposes: •To elect the 10 directors named in the proxy statement for the coming year; •To approve our named executive officers’ compensation in an advisory vote; •To approve the Synchrony Financial 2024 Long-Term Incentive Plan; •To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2024; •To approve an amendment to the Company's Amended and Restated Certification of Incorporation to reflect recently amended Delaware law provisions regarding officer exculpation; and •To consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting. The meeting will be held virtually to provide expanded access, improved communication and cost savings for our stockholders and Synchrony Financial. Hosting a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location. Our virtual meeting is designed to ensure that all attendees are afforded the same rights and opportunities to participate as they would at an in-person meeting. During the live Q&A session of the meeting we will answer questions as they come in, and we commit to publishing each relevant question received following the meeting. The live webcast is available to stockholders and the general public at the time of the meeting, and a replay of the meeting is made publicly available on the company’s website. The website address for the virtual meeting is: www.virtualshareholdermeeting.com/SYF2024. To participate in the meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials. The meeting will begin promptly at 11:00 a.m., Eastern Time. Online check-in will begin at 10:45 a.m., Eastern Time, and you should allow for time to complete the online check-in procedure. You are eligible to vote if you were a stockholder of record at the close of business on April 16, 2024. Proxy materials are being mailed or made available to stockholders on or about April 25, 2024. Whether or not you plan to attend the meeting, please submit your proxy by mail, internet or telephone to ensure that your shares are represented at the meeting. Sincerely, Jonathan S. Mothner Executive Vice President, Chief Risk and Legal Officer April [--], 2024 | | | PROXY LOGISTICS AT A GLANCE DATE June 11, 2024 TIME 11:00 a.m. Eastern Time VIRTUAL MEETING WEBSITE ADDRESS www.virtualshareholder meeting.com/SYF2024 RECORD DATE April 16, 2024 IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING TO BE HELD ON JUNE 11, 2024 Our proxy materials relating to our Annual Meeting (notice, proxy statement and annual report) are available at www.proxyvote.com. |

2024 ANNUAL MEETING AND PROXY STATEMENT / 1

2 / 2024 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| APPENDIX A: SYNCHRONY FINANCIAL 2024 LONG-TERM INCENTIVE PLAN | | |

| | | |

2024 ANNUAL MEETING AND PROXY STATEMENT / 3

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

| | PROXY SUMMARY | |

| | | | | | |

| | This summary highlights certain information in this proxy statement in connection with our 2024 Annual Meeting of Stockholders (the “Annual Meeting”). As it is only a summary and does not contain all of the information you should consider, please review the complete proxy statement before you vote. In this proxy statement, references to the “Company” and to “Synchrony” are to Synchrony Financial. For answers to frequently asked questions regarding the Annual Meeting, please refer to pages 78-80 of this proxy statement. Proxy materials are being mailed or made available to stockholders on or about April 25, 2024. | |

| | | | | | |

| | LOGISTICS | VOTING | |

| | | | | | |

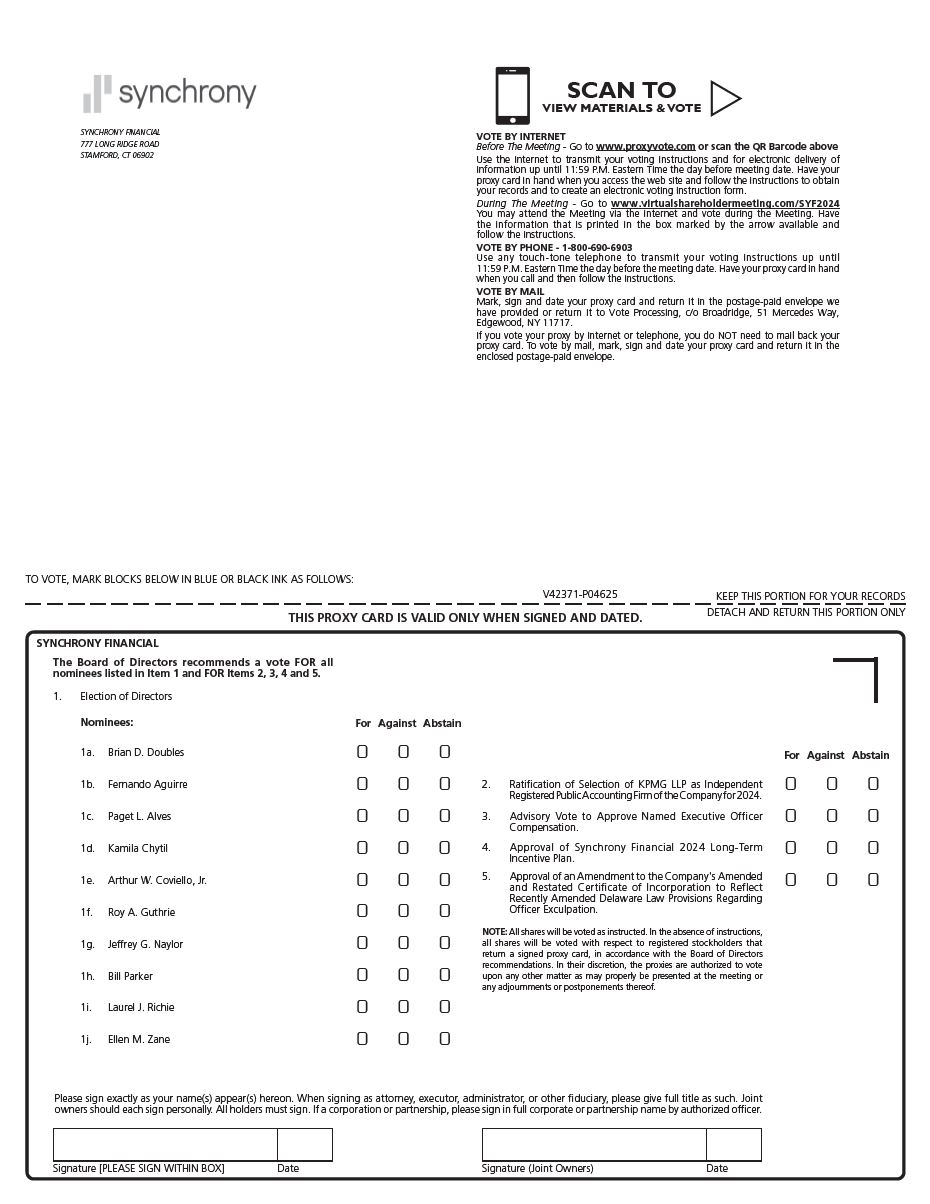

| | | DATE June 11, 2024 | | BY MAIL You may date, sign and promptly return your proxy card by mail in a postage prepaid envelope (such proxy card must be received by June 10, 2024). | |

| | | | | |

| | | TIME 11:00 a.m. Eastern Time | | |

| | | | |

| | | BY TELEPHONE You may use the toll-free telephone number shown on your Notice of Internet Availability of Proxy Materials (the “Notice”) or proxy card up until 11:59 p.m., Eastern Time, on June 10, 2024. | |

| | |

| | | | |

| | | VIRTUAL MEETING WEBSITE ADDRESS www.virtualshareholdermeeting.com/SYF2024 | |

| | | |

| | | | |

| | | BY THE INTERNET In Advance You may vote online by visiting the internet website address indicated on your Notice or proxy card or scan the QR code included on your Notice or proxy card with your mobile device, and follow the on-screen instructions until 11:59 p.m., Eastern Time, on June 10, 2024. At the Annual Meeting You may attend the virtual Annual Meeting by visiting this internet website address: www.virtualshareholdermeeting.com/SYF2024. | |

| | | | |

| | | RECORD DATE April 16, 2024 | |

| | | | | |

| | | | | |

| | ELIGIBILITY TO VOTE You are eligible to vote if you were a stockholder of record at the close of business on April 16, 2024. | | |

| | | |

| | | |

| | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| AGENDA | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Election of 10 directors named in this proxy statement Voting standard: Majority of votes cast Page Reference — 18 BOARD RECOMMENDATION FOR | | | | Ratify the selection of KPMG LLP as our independent registered public accounting firm for 2024 Voting standard: Majority of votes cast Page Reference — 32 BOARD RECOMMENDATION FOR | | | | Advisory approval of our named executive officers’ compensation Voting standard: Majority of votes cast Page Reference — 33 BOARD RECOMMENDATION FOR | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | |

| | | Approval of Synchrony Financial 2024 Long-Term Incentive Plan Voting standard: Majority of votes cast Page Reference — 66 BOARD RECOMMENDATION FOR | | | | Approval of an Amendment to the Company's Amended and Restated Certification of Incorporation to reflect recently amended Delaware law provisions regarding officer exculpation Voting standard: Majority of voting power of shares outstanding and entitled to vote thereon Page Reference — 73 BOARD RECOMMENDATION FOR |

| | | | | | | | | | | | | |

4 / 2024 ANNUAL MEETING AND PROXY STATEMENT

EXECUTIVE SUMMARY

In 2023, Synchrony delivered another year of strong financial performance – including record purchase volume – by once again putting the value of experience, the strength of our operating model, and strategic investments in play to deliver for customers, partners, the Company, shareholders, and external stakeholders.

Synchrony achieved continued strong growth, improved operating efficiency, and delivered strong risk-adjusted returns – all while maintaining a robust balance sheet. These results were achieved while prioritizing good governance and sound risk management. The Company enhanced our customer experiences and customer acquisition through simplification, product development, and innovation. Synchrony continues to invest in a strong culture by co-creating with our employees an experience that works for our team and for our business, including a focus on total wellness, work-life balance and Equity, Diversity, Inclusion and Citizenship (“EDIC”). We earned external awards and recognition, including:

•Fortune:

Fortune 100 Best Companies to Work For® -

U.S.—2024 (#5)

•Great Place To Work®:

Best Workplaces for Parents - U.S. (#10)

Best Companies to Work For - Philippines (#1)

•The Economic Times:

Top 100 Best Companies to Work For - India (#5)

Overall, 95% of our employees say Synchrony is a great place to work, compared to 57% at a typical U.S. company.

Synchrony continued to support the communities in which we serve and live by investing in education and other community programs through our skills programs and other outreach.

KEY FINANCIAL HIGHLIGHTS

| | | | | | | | |

$2.2B | | in net earnings |

2.0% | | return on assets |

$103B | | in loan receivables |

$1.5B | | in capital returned to shareholders |

34.9% | | Efficiency Ratio* |

*Efficiency Ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income.

GROWTH AND RETURNS

In 2023, Synchrony delivered double digit growth in loan receivables of $10.5 billion. This was possible through our execution across multiple strategic initiatives, including the expansion of our distribution channels, continued scaling of new products to offer our customers flexibility and choice, and signing or renewing over 50 partnerships. Key metrics demonstrating our growth in 2023 include:

| | | | | | | | |

25+ | | new partnerships |

| 30+ | | partnership renewals |

~23M | | new accounts |

2.8% | | increase in purchase volume to a record $185 billion |

11.4% | | increase in loan receivables to $103 billion |

Growth in our Health and Wellness platform contributed to this performance and was highlighted by a 14.7% increase in purchase volume, a 13.3% increase in average active accounts, and 19.2% increase in interest and fees on loans. These results reflected continued higher promotional purchase volume, broad-based growth led by our Dental, Pet and Cosmetic verticals, and lower customer payment rates. The financing flexibility that our products offer, coupled with seamless customer experiences, contributes to a loyal customer base with high repeat behavior and consistently strong satisfaction scores.

Digital platform purchase volume increased 7.1%, with growth in average active accounts. Diversified & Value purchase volume increased 8.0%, reflecting higher out-of-partner spend, strong retailer performance, and average active account growth of 5.8%. Lifestyle purchase volume increased 7.7%, with higher transaction values in Outdoor and Luxury. In Home & Auto, purchase volume was flat, as growth in commercial, Home Specialty and Auto were offset by lower retail traffic in Furniture and Electronics and the impact of lower gas and lumber prices.

Overall, our growth in 2023 exceeded internal goals, reflecting our differentiated business strategy that prioritizes sustainable growth at strong risk-adjusted returns, even as market conditions change and customer needs evolve.

2024 ANNUAL MEETING AND PROXY STATEMENT / 5

FINANCIAL FOUNDATION

Synchrony balances strategic goals focused on growth by also maintaining a resilient financial foundation, including:

•Funding – deposit balances grew by over $9 billion in a competitive funding environment.

•Capital – the Company returned $1.5 billion to shareholders, including a 7% increase in dividends per share and $1.1 billion of share repurchases – reducing common shares outstanding by 7% or 31 million shares.

•Efficiency Ratio – improved industry-leading efficiency ratio of 34.9%, driven by higher revenue partially offset by higher expenses.

Furthermore, during 2023, we initiated workstreams to develop strategies to mitigate the anticipated impact of changes to credit card late fee rules, which were issued in March 2024. These workstreams explored product, policy and pricing changes to allow us to continue to provide credit to our customer base while attempting to minimize the impact of a reduction to credit card late fees on our business.

CUSTOMER EXPERIENCE

Synchrony continues to enhance our customer experience by focusing on digital products and capabilities, deeper and more personalized relationships and simplified interactions.

Digital Transformation – The Company continues to focus its efforts on digital experiences through a number of specific projects, including our authentication software moving us toward a 'universal ID' for our applications and integration of all digital tools. The Company has strategically positioned mobile wallets as a distribution channel, launching multiple capabilities for clients. We also launched our Synchrony Marketplace online and within our MySynchrony native app, where shoppers can access hundreds of offers promoting our partner brands supported by Synchrony's tailored multiproduct financing solutions. In fact, as Synchrony leverages our analytics and marketing capabilities to develop compelling cross-shopping opportunities in this initial launch, Synchrony Marketplace has attracted more than 220 million visits by shoppers for our partners, providers and merchants, as we more than doubled the number of partners participating.

Product Development and Innovation – A mix of new and improved capabilities are helping Synchrony grow and provide great customer experiences.

•Synchrony Pay Later is providing installment loans as an option for financing

•SyPI provides a digital app experience within our partner’s own app

•MySynchrony native app is providing a Synchrony experience that supports customer interaction

•Third-party real-time analysis and optimizer to provide improved pricing and portfolio segmentation for our savings products

•Direct payments with the Federal Reserve is improving the speed and efficiency for payments by customers

Simplifying Customer Interactions – Synchrony has optimized our websites to ensure a clear and efficient user interface to help drive organic online traffic to both Synchrony and partners. And with PRISM, we have improved credit decisions in the application process, maintaining approval rates, and protecting our risk-based discipline for extending credit. We have also simplified several customer requests and actions such as 1-click autopay and credit dispute inquiries.

GOVERNANCE AND RISK MANAGEMENT

At Synchrony, we promote and value a sound risk culture which results in (i) better risk management that allows us to identify, assess, and mitigate risks more efficiently; (ii) improved compliance that helps us to adhere to relevant laws, regulations and ethical standards; (iii) better decision-making by encouraging open and honest communication; (iv) a stronger reputation which helps retain customers, employees, and investors; and (v) increased employee engagement by valuing transparency, accountability, and collaboration helping to reduce turnover.

In addition to day-in-day-out risk oversight of the business, in 2023 the Company continued to adhere to a rigorous annual process that reviews (i) the behaviors and risk-based outcomes of our leaders and (ii) incentive programs for individuals or groups of individuals who could, together, put the Company at risk. Both of these processes and associated results were reviewed with the Board of Directors (the “Board”) and confirmed a strong risk culture at Synchrony, evidenced in part, by an independent third party risk assessment of each of our incentive plans that highlighted no concerns and an internal process that distills a company-wide set of risk events, to issues being investigated, to adverse risk outcomes that are discussed after root causes are identified and appropriate actions

are taken.

Specific improvements and actions taken in 2023 that support our governance and risk management include:

•Enhanced Prudential Standards Compliance – As of March 31, 2023, Synchrony’s average total consolidated assets exceeded $100 billion. As a result, we will become subject to enhanced prudential standards following applicable transition periods. During 2023, we established new procedures and governance in preparation for compliance with these enhanced standards, including by implementing monthly reporting on loans and liquidity filings, conducting readiness activities for Comprehensive Capital Analysis and Review examinations by regulators, and deploying a risk-based pricing team.

6 / 2024 ANNUAL MEETING AND PROXY STATEMENT

•Governance Review – In 2023, Synchrony kicked off a company-wide initiative to review and refine our corporate governance practices across all our functions to enhance our risk culture and drive sustainable growth. This initiative helped ensure (i) cultural awareness that compliance and risk management are everyone’s responsibility – from call center agents, to process owners, to our executive leadership team, (ii) issues are timely identified and escalated to senior leaders when our customers are impacted and (iii) we have the appropriate tools and controls to adequately manage risk within our Company.

SUPPORTING OUR EMPLOYEES

Based on feedback from employees, we continued to invest in our people through enhancements in both mental and physical wellness, compensation, benefits, flexibility and career development. We maintained our support for employees to choose where and how they work best which allows our diverse workforce – with diverse needs – the ability to choose the option that works best for them and to reap the benefits of greater work/life balance.

We also continue to recognize the important role our associates play in driving our business forward. Synchrony funded its Performance Plus Bonus program for full-time, frontline hourly associates in our U.S. contact centers at $1,250 – well above the target of $750. In addition, in the first quarter of 2024, we paid a special inflation bonus of $1,000 to our full-time non-exempt and other employees to help alleviate the impacts of inflation to those feeling the most outsized impacts.

A summary of highlights of our current benefit programs and additional changes in 2023 to support employees include:

•Thrive Global – Synchrony’s newest employee wellness resource, Thrive Global, is a science-backed well-being platform designed to help people create sustainable, healthy habits that improve resilience and performance through continuous, whole-human support. It includes a full suite of wellness tools and resources, including daily check-in questions, wellness challenges and Thrive Resets, which are 60-second videos that help employees take a meaningful pause to recharge and transition between customer service calls or during other work. Thrive Global helps build stress-relief and mental well-being into employees’ daily workflows, improving the overall employee experience, which in turn improves our customer experience.

•Wellness Reimbursement Program – In 2023, we made two changes to our wellness reimbursement program to (i) increase the amount of the benefit from $300 to $500 per year and (ii) allowed a wider range of wellness activities or goods included in the program such as fitness classes, music and art lessons, home gym equipment, and nutrition programs.

•Financial Wellness – We continue to support employees through financial wellness programs including: (i) a financial education portal to help Synchrony employees sharpen their personal money management skills and make smart decisions about their spending habits,

building credit, saving for retirement, reducing debt and investing wisely; and (ii) Rainy Day Savings Fund – a program where employees who took financial education lessons from our online education portal and saved between $3 and $5 each pay period for a total of six months received a $65 cash deposit from Synchrony. We also continue to make free, relatable personal finance resources available through our Money 360 program.

•Maternity/Parental Leave – In 2023, we expanded our support for new parents by ensuring a minimum level of paid time off globally. Our global programs support new parents through a mix of combined maternity and/or parental leave with 22 weeks of 100% paid leave for parents who give birth and 12 weeks of 100% paid leave for all other new parents including adoptions.

•Sabbaticals – The Synchrony Sabbatical and Employee Balance programs let employees reduce their schedules or take anywhere from one to 12 months leave while retaining benefits. It’s part of our broader commitment to flexibility and investments in our people’s well-being.

•Well-Being Coaches – We continue to expand our well-being support for employees by adding dedicated coaches with diverse backgrounds that match our workforce. These coaches help employees create personalized wellness strategies and serve as guides for benefits and resources. Our slate of well-being coaches also partner with Synchrony's eight diversity networks to support various initiatives throughout the year.

•Gender Affirming Benefits – Our Gender Affirming coverage includes the most common and safe surgeries available. This is a special and unique benefit that Synchrony offers above and beyond what other companies provide.

•Fertility and Family Planning – Our fertility benefit provides a comprehensive and easy-to use program that covers multiple paths to parenthood, including couples struggling with fertility, LGBTQ+ families, single parents by choice and singles/couples who require donor tissue. The program includes three cycles of fertility treatment and covers cost from beginning to end.

•Adoption and Surrogacy Assistance – In 2023, to better support our employees’ paths to parenthood, we added coverage for surrogacy and expanded our financial support from $8,000 to $35,000 per adoption or surrogacy arrangement.

•Tuition Reimbursement – Synchrony has an industry leading tuition reimbursement program that provides up to $20,000 per year for full-time employees, $5,000 per year for part-time employees and up to $9,000 for skill-based certifications. In addition, we cover up to $4,000 per year for academic fees such as registration fees, lab use fees, books, and course-related software. Our tuition reimbursement program covers degrees relevant to an employee's job as well as healthcare and education-related degree programs. In partnership with the Bright Horizons EdAssist program, Synchrony can pay employees’ tuition directly through our Debt-Free Tuition option, offering no out-of-pocket cost for employees.

2024 ANNUAL MEETING AND PROXY STATEMENT / 7

SUPPORTING EMPLOYEES AND COMMUNITIES THROUGH EQUITY, DIVERSITY AND INCLUSION

We are committed to creating an environment that is inclusive and helps everyone be their best. Our Equity, Diversity, Inclusion and Citizenship programs aim to evolve the workforce to reflect the diversity of the populations in the communities we serve, nurture a culture of inclusion where employees are valued as their authentic selves, and increase access to education for those who need it most. These are some of our programs:

Pay Equity – Since 2018, Synchrony has hired an independent third party to analyze pay equity for all employees. In 2023, Synchrony continued our annual practice of reviewing the Company’s pay equity for all employees globally, including base pay, cash incentive plans, and stock-based compensation. The third-party analysis in 2023 continued to support our goal to maintain 100% pay equity for employees across genders globally and across racial/ethnic groups in the United States, as well as our commitment to improve Synchrony’s compensation processes to better support equity. Synchrony is committed to continuing our global pay equity analysis and disclosing the results each year.

New Way of Working – Realizing that employees have diverse needs and to help all employees feel included in Synchrony’s culture, the Company continues to provide choice and flexibility on where employees work. Feedback from our workforce and externally by potential employees wanting to work at a company with an inclusive culture

has been very positive. In 2023, our voluntary turnover in the United States was over 40% lower than pre-pandemic levels, our applicant pools for exempt roles nearly doubled pre-pandemic levels, and business results continued to improve in spite of challenging economic conditions.

Inclusive Culture – At Synchrony, we believe in a strong employee culture that supports EDIC and bolsters business results by:

•Attracting and retaining top talent who are looking for a supportive and engaging workplace. This has helped mitigate turnover and improve employee retention.

•Boosting employee morale and engagement, which leads to higher productivity and better job performance.

•Improving teamwork and collaboration, which can lead to better problem-solving, more efficient decision-making, and improved results.

•Building a positive Company reputation, which helps attract top talent, new customers, investors, and business partners.

Diversity – In 2023, we published our first Diversity Report that provides transparency and a holistic overview of our diversity accomplishments and program. Our ability to cultivate and sustain a diverse workforce that reflects our customers and communities we serve, combined with our focus to hire the most qualified candidate for each role, is what drives our approach. In 2023, we had a year-over-

year increase in diverse demographics driven in part by increasing representation of Blacks and Hispanics at Vice President and above levels in the United States and increasing the number of females in Vice President and above roles globally. As of December 2023, our

workforce in the United States comprised 50% non-white, including 19% Black, 17% Hispanic, 7% Asian and globally,

61% female.

Other initiatives include:

•Diverse Pipeline – In 2023, we expanded our development programs designed to increase our pipeline for executive roles in the Company by including more diverse populations.

•Supplier Diversity – Our continued efforts to support diverse suppliers have increased diverse representation in companies included in our Request for Proposals (“RFPs”). In 2023, we achieved a 15% increase from prior year in the number of diverse suppliers included in RFPs. Of the diverse suppliers included in RFPs, we increased the total number of diverse suppliers by 26% – from 62 to 78. As a result, we ended 2023 with our diverse supplier spend increasing by 95% from 2022.

•Investing in Diverse Startups – Synchrony announced a $100 million commitment in Ariel Alternatives’ Project Black Fund, which aims to scale sustainable minority-owned businesses and position them as leading suppliers to Fortune 500 companies. Project Black invests in middle-market companies that are not currently minority owned, as well as existing Black- and Hispanic-owned businesses, providing capital, resources and minority executive talent. Under Project Black’s ownership, these companies are expected to be transformed into certified minority business enterprises (“MBEs”) of scale to fuel Fortune 500 vendor and supply chain diversity. Synchrony, along with other investors, plans to explore collaboration opportunities with portfolio company management teams to pursue growth strategies. In addition to our $100 million commitment to Project Black, Synchrony Ventures has committed $45 million to venture capital funds led by diverse partners with a track record of investing in minority-owned start-ups since 2021. In 2020, the Synchrony Foundation committed $5 million over four years to support funding of small business. In 2023, $1 million of this commitment went to support Operation Hope which offers technical support and financial counseling to small business owners.

Synchrony was recognized for its work by the Executive Leadership Council (ELC), as their 2023 Corporate Award recipient for outstanding commitment to achieving DEI.

8 / 2024 ANNUAL MEETING AND PROXY STATEMENT

Synchrony has made EDIC a continued priority for the Company by creating a culture that enables every colleague to be their complete, authentic self-evidenced by our Great Place to Work® rankings, pay equity results, low turnover, and large candidate pools for open positions.

Our focus on supporting our employees and enhancing their engagement has led the Company to once again be recognized as a Great Place to Work® on Fortune’s Best Companies to Work For® list, which uses employee feedback as a core criterion. Synchrony has moved up the list every year since 2019 and we're now in the Top 5 in the United States. Great Place to Work® also ranked Synchrony in the top spot in the Philippines and number five in India. Overall, 95% of employees say Synchrony is a great place to work, compared to 57% at a typical U.S. company.

SUPPORTING OUR COMMUNITIES

At Synchrony, our values drive how we work, how we serve our customers and partners, and how we engage in the communities where we live and work every day. Over the last five years, Synchrony’s community development lending and investment activities totaled more than $1.6 billion. In 2023, Synchrony continued to support our communities in a variety of ways including (i) Community Reinvestment Act ("CRA") investments; (ii) grant donations through our Education as an Equalizer initiative; (iii) financial education and inclusion; and (iv) skills and career development. Synchrony was recognized for the fifth year in a row on JUST Capital’s JUST 100 list of America’s Most

JUST Companies.

•CRA – Investments totaling $265 million that will add or preserve affordable housing serving households with income from less than 30% of area median income ("AMI") to up to 80% of AMI.

•Education as an Equalizer – An initiative to expand access to higher education, skills training in high-growth fields and financial literacy for underserved communities and our own workforce. Since 2021, we have distributed over $19 million in grants and provided more than 1,400 scholarships through this initiative.

•Financial Education and Inclusion – Synchrony participates in Project REACh – Roundtable for Economic Access and Change – as a member on the steering committee of the Alternative Credit Assessment Utility Workstream, one of four workstreams under Project REACh, working to improve credit availability and consumer financial literacy for underserved communities, individuals and small businesses. In 2023, Synchrony continued to use bank and deposit account data made available through Project REACh to extend credit to the “credit invisible” population – consumers who have no record or trade lines at the credit bureau. Through our efforts to date, we have observed that over 50% of new account holders offered credit utilizing Project REACh data attained a “prime” 651+ Vantage score within

12 months.

•Skills and Career Development – Synchrony supports multiple partnerships with organizations already on the front lines of bringing education, skills training and career placement to the underserved in their communities including Latinx Executive Alliance, and The Mom Project. Our multi-million-dollar state-of-the-art Synchrony Skills Academy located at our headquarters in Stamford, CT holds community programs focused on skilling and reskilling the local workforce.

OUR NAMED EXECUTIVE OFFICERS

The executive officers whose compensation we discuss in this Compensation Discussion and Analysis section (“CD&A”) – our named executive officers (“NEOs”) for 2023 – are Brian D. Doubles, President and CEO; Brian J. Wenzel, Sr., Executive Vice President, CFO; Carol D. Juel, Executive Vice President and Chief Technology and Operating Officer; Jonathan S. Mothner, Executive Vice President, Chief Risk and Legal Officer and Curtis Howse, Executive Vice President and CEO, Home & Auto.

In September 2023, the Board approved the following changes to roles and responsibilities of our NEOs:

•Jonathan S. Mothner was appointed Executive Vice President, Chief Risk and Legal Officer effective November 1, 2023. He previously served as our Executive Vice President, General Counsel and Secretary from February 2014 to October 2023.

2024 ANNUAL MEETING AND PROXY STATEMENT / 9

COMPENSATION PHILOSOPHY

TARGET COMPENSATION

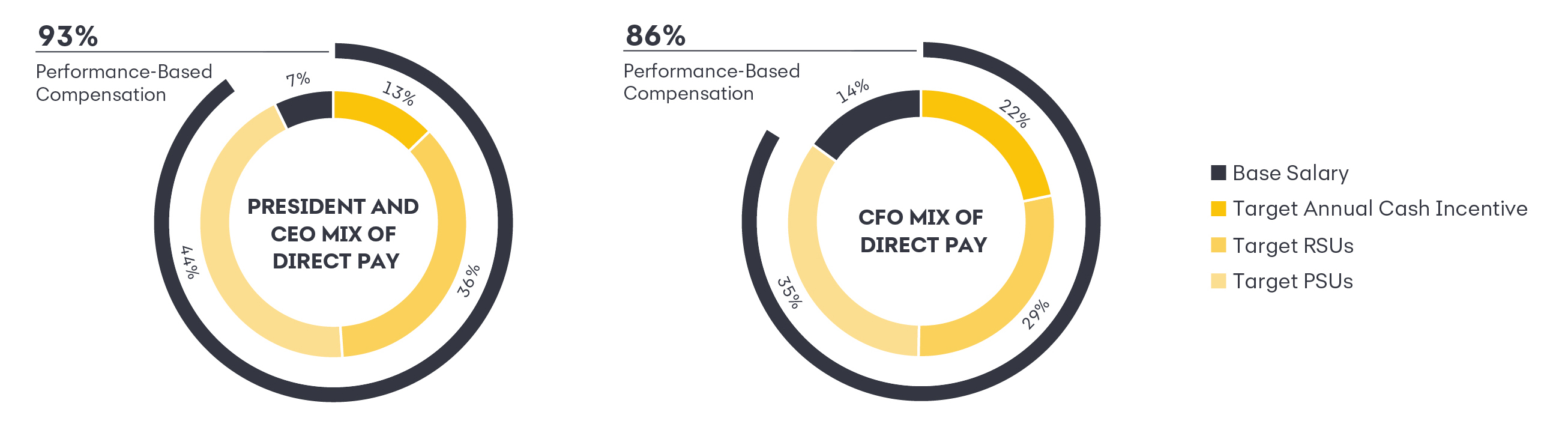

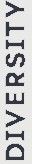

A majority of our NEOs’ compensation is performance-based and therefore at risk. The only fixed compensation paid is base salary, which represents approximately 7% of the CEO’s total direct compensation and no more than 17% of the other NEOs’ total direct compensation. Below are the 2023 mix of direct pay charts for our CEO and CFO:

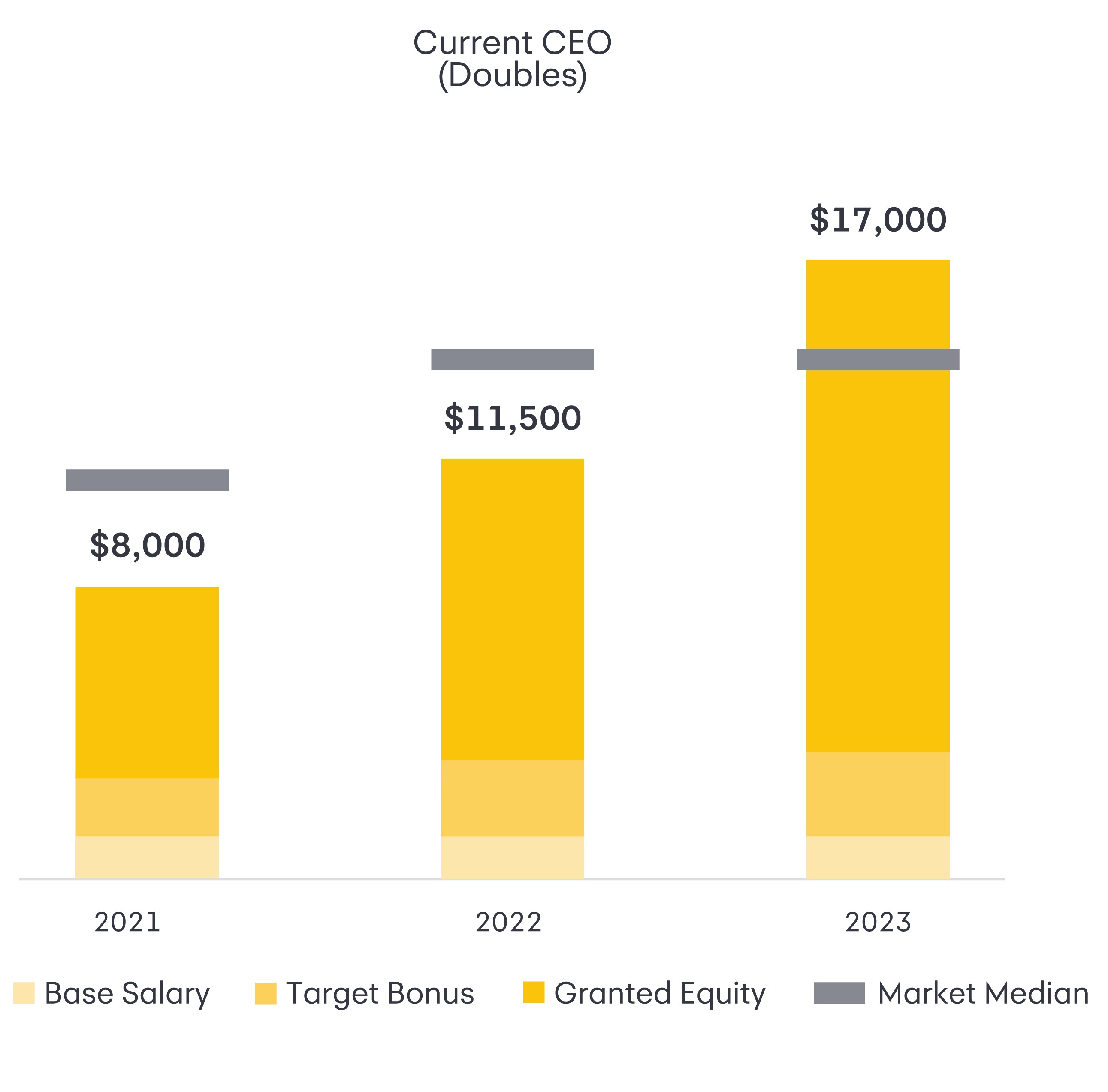

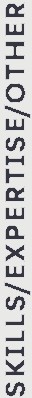

Below we illustrate our CEO Target pay from 2021 to 2023 and alignment with market and our compensation philosophy. For each year we have shown market median (in thousands) as reported in proxy filings by peer companies that year.

SYNCHRONY CEO DIRECT PAY VS MARKET

As part of our compensation philosophy, the Management Development and Compensation Committee ("MDCC") targets median pay but may set total compensation above or below the median based on a variety of factors including but not limited to, each executive's role, responsibilities, experience, and performance. Mr. Doubles’ pay was initially set below median as part of the planned CEO succession with the intent of increasing his target pay over a multi-year time period. The MDCC will continue to use market data to help inform its decision-making regarding competitive pay levels and to understand how Mr. Doubles' compensation compares to the market for comparable CEOs.

10 / 2024 ANNUAL MEETING AND PROXY STATEMENT

2023 SAY-ON-PAY ADVISORY VOTE AND STAKEHOLDER

ENGAGEMENT ON EXECUTIVE COMPENSATION

At our 2023 annual meeting of stockholders, our investors supported the compensation for our named executive officers with more than 93% of the votes approving the advisory say-on-pay proposal. The MDCC considers the results of our say-on-pay advisory vote as part of its review of our overall compensation programs and policies. In 2023, we continued our regular engagement with stakeholders regarding our compensation program. We also engaged with proxy advisory firms and sought regulatory perspectives.

BEST PRACTICE COMPENSATION PROGRAMS AND POLICIES

The MDCC has implemented the following measures as part of our executive compensation programs:

| | | | | |

WHAT WE DO |

| Substantial portion of executive pay based on performance against goals set by the MDCC |

| Risk governance framework underlies compensation decisions |

| Stock ownership requirements for executive officers |

| Minimum vesting of 12 months for any options or stock appreciation rights |

| Minimum vesting of 12 months for any restricted stock units (“RSUs”) |

| Greater percent of equity grants in Long-Term Performance Share Units (“PSUs”) (55% of the LTI mix) |

| Compensation subject to claw-back in the event of misconduct in addition to “no fault” in the case of financial restatements for all NEOs |

| Limited perquisites |

| Peer company benchmarking, targeting median among peers with additional consideration based on the size,

scope and impact of role, market data, leadership skills, length of service and both company and individual performance and contributions |

| Double-trigger vesting of equity and long-term incentive plan awards upon change in control |

| Annual “Say-on-Pay” frequency |

| Independent compensation consultant advises the MDCC |

| Include relative performance metric via Total Shareholder Return modifier on long-term performance awards

linked to stockholder returns relative to peers |

| Significant portion of incentive compensation mix in equity |

| | | | | |

WHAT WE DON’T DO |

| No hedging or pledging, short selling, or option trading of Company stock |

| No employment agreements for executive officers |

| No tax gross-ups on perquisites for executive officers |

| No cash buyouts of stock options or stock appreciation rights with exercise prices that are not in-the-money |

| No payout of dividends on unvested equity prior to the vesting date |

| No backdating or repricing of stock option awards |

| No CIC excise tax gross-ups for executive officers |

2024 ANNUAL MEETING AND PROXY STATEMENT / 11

| | | | | | | | |

| | |

| CORPORATE GOVERNANCE We believe that strong corporate governance is integral to building long-term value for our stockholders and enabling effective Board oversight. We are committed to governance policies and practices that serve the interests of the Company and its stockholders. The Board monitors emerging issues in the governance community and regularly reviews our governance practices to incorporate evolving best practices and stockholder feedback. |

| |

A FEW OF OUR CORPORATE GOVERNANCE BEST PRACTICES INCLUDE:

BOARD LEADERSHIP STRUCTURE

Our Board is led by Jeffrey Naylor, our non-executive Chair. Mr. Naylor assumed this role in April 2023 after serving as Lead Independent Director since April 2021, and has served as an independent director on our Board since 2014.

Our Board, led by the Nominating and Corporate Governance Committee, annually reviews the Board's leadership structure and has determined to re-elect Mr. Naylor as non-executive Chair. We continue to believe that having an independent director serve as the non-executive Chair of the Board is in the best interests of our stockholders and is the appropriate leadership structure for the Company at this time. The separation of roles allows our Chair to focus on the organization and effectiveness of the Board. At the same time, it allows our CEO to focus on executing our strategy and managing our operations, performance and risks.

BOARD’S ROLE IN STRATEGY

The Board actively oversees the Company’s strategic direction and the performance of our business and management. On an annual basis, the Board conducts an intensive, multi-day review of the Company’s short-, medium- and long-term strategic plan, taking into consideration economic, consumer, technology, regulatory and other significant trends and changes, as well as other developments in the industry impacting our business. The Board’s input is then incorporated into the strategic plan and approved at the subsequent Board meeting. The output of these meetings provides the strategic context for the Board’s discussions at its meetings throughout the next year, including regular updates and feedback from the Board on the Company’s progress on its strategic plan and deep dives on developments in important areas such as cybersecurity and healthcare. In addition, the Board regularly discusses and reviews feedback on strategy from our stockholders and other stakeholders, and often engages with internal and external experts and advisors to ensure our strategy reflects the latest competitive landscape.

Looking ahead, the Company remains focused on improving all aspects of the customer experience, starting with a quick, seamless account opening process all the way through account self-servicing features. The Board will oversee our plan to continue to invest heavily in digital innovations to develop new products and services that drive deeper customer relationships.

BOARD'S ROLE IN RISK OVERSIGHT

We manage enterprise risk using an integrated framework that includes Board-level oversight, administration by a group of cross-functional management committees, and day-to-day implementation by a dedicated risk management team led by the Chief Risk Officer ("CRO"), a role currently held by our Chief Risk and Legal Officer. The Board (with input from the Risk Committee) is responsible for approving the Company’s enterprise-wide risk appetite statement and framework, as well as certain other risk management policies, and oversees the Company’s strategic plan and enterprise-wide risk management program.

The Board regularly devotes time during its meetings to review and discuss the most significant risks facing the Company and management’s responses to those risks. During these discussions, the President and CEO, the CFO, the CRO, the Managing General Counsel and other members of senior management present management’s assessment of risks, a description of the most significant risks facing the Company and any mitigating factors and plans or practices in place to address and monitor those risks. The Board has also delegated certain of its risk oversight responsibilities to its committees.

The Risk Committee of the Board has responsibility for the oversight of the risk management program, and the four other board committees have oversight roles with respect to risk management within their respective oversight areas. Several management committees and subcommittees have important roles and responsibilities in administering the risk management program. This committee-focused governance structure provides a forum through which risk expertise is applied cross-functionally to all major decisions, including development of policies, processes and controls used by the CRO and risk management team to execute our risk management philosophy. The CRO manages our risk management team and is responsible for establishing and implementing standards for the identification, management, measurement, monitoring and reporting of risk on an enterprise-wide basis. The CRO regularly reports to the Board of Directors and the Risk Committee on risk management matters. The enterprise risk management philosophy is to ensure that all relevant risks are appropriately identified, measured, monitored and controlled. The approach in executing this philosophy focuses on leveraging risk expertise to drive enterprise risk management using a strong governance framework structure, a comprehensive enterprise risk assessment program and an effective risk appetite framework.

12 / 2024 ANNUAL MEETING AND PROXY STATEMENT

Responsibility for risk management flows to individuals and entities throughout our Company, including the Board, various Board and management committees and senior management. The corporate culture and values, in conjunction with the risk management accountability incorporated into the integrated Enterprise Risk Government Framework, which includes a governance structure and three distinct “Lines of Defense” (as further described below), has facilitated, and will continue to facilitate, the evolution of an effective risk presence across the Company.

The “First Line of Defense” is comprised of the business areas whose day-to-day activities involve decision-making and associated risk-taking for the Company. As the business owner, the first line is responsible for identifying, assessing, managing and controlling that risk, and for mitigating our overall risk exposure. The first line formulates strategy and operates within the risk appetite and risk governance framework. The “Second Line of Defense,” also known as the independent risk management organization, provides oversight of first line risk-taking and management. The second line assists in determining risk capacity, risk appetite, and the strategies, policies and structure for managing risks. The second line owns the risk governance framework. The “Third Line of Defense” is comprised of Internal Audit. The third line provides independent and objective assurance to senior management and to the Board and Audit Committee that first and second line risk management and internal control systems and its governance processes are well-designed and working as intended.

BOARD OVERSIGHT OF CYBERSECURITY AND TECHNOLOGY

The protection and security of financial and personal information of our consumers is one of the Company’s highest priorities. To that end, we have an extensive cybersecurity oversight framework in place, which includes oversight of cybersecurity risk. The Board and its Risk Committee receive regular reports on cybersecurity and the Company ensures the Board includes members with cybersecurity experience. The information security program includes administrative, technical and physical safeguards and is designed to provide an appropriate level of protection to maintain the confidentiality, integrity, and availability of our Company’s, our client's and our customers’ information. This includes protecting against known and evolving threats to the security or integrity of customer records and information, and against unauthorized access, compromise or loss of customer records or information. For more information regarding our cybersecurity risk management strategy and governance, please see "Item 1C. Cybersecurity" in our Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission ("SEC") on February 8, 2024.

A key part of our strategic focus is the continued development of innovative, efficient, and flexible technology to deliver products and services that meet the needs of our partners and customers and enables us to operate our business efficiently. The integration of our technology with our partners is at the core of our value proposition, enabling us to anticipate and deliver the experiences and tools our partners and consumers want, while reducing fraud and enhancing customer service. Recognizing the importance of technology and innovation to our future success, and in order to better leverage the Board’s technology expertise, we have a committee of the Board devoted exclusively to technology and innovation. The Technology Committee reviews and advises the Board on major strategies and other subjects relating to the Company’s approach to technology-related innovation, the technology development process and existing and emerging technologies, including artificial intelligence. The Chair of the Technology Committee is Art Coviello, a leader in the technology industry and former Executive Vice President of EMC Corporation and Executive Chairman of RSA Security, Inc.

BOARD COMMITMENT TO DIVERSITY

Since our IPO, the Board has consistently believed that sustainable, long-term stockholder value creation requires caring for our business, our customers, our partners, our employees, our communities, and the environment. We believe diversity makes our business stronger, more innovative and more successful. We have strong hiring practices for women, minorities, veterans, the LGBTQ+ community and people with disabilities. We promote this inclusive culture by sponsoring eight different employee Diversity Networks.

Five of our 10 directors are women and/or minorities; nine are independent; three are women and three are considered members of minority groups. This diversity enables our Board to guide and oversee management more effectively, bringing strategically relevant, forward-looking and inclusive perspectives to our boardroom.

Since 2020, our Board has elevated its attention to social justice and racial equity within Synchrony and in our communities. Our Board receives regular updates on progress in Synchrony’s EDIC efforts. Our directors have hosted all-employee events on EDIC in the workplace, participated in our annual Global Diversity Experience, and shared their thought leadership on EDIC at conferences.

2024 ANNUAL MEETING AND PROXY STATEMENT / 13

BOARD FOCUS ON OTHER ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

Our Board actively engages on diversity and other environmental, social and governance matters ("ESG") topics throughout the year. Our Board delegates primary responsibility for oversight of our ESG strategy and performance to our Nominating and Corporate Governance Committee. The Committee receives updates from management on ESG matters at least four times per year. All of our Board committees oversee matters that impact our ESG strategy and performance. For example: our Audit and Risk Committees oversee compliance matters; our Risk

Committee oversees cybersecurity risks associated with information security and data privacy; and our Management Development and Compensation Committee oversees human capital practices, including our EDIC efforts. Our Nominating and Corporate Governance Committee and our Management Development and Compensation Committee hold an annual joint meeting on ESG reflecting the significance of human capital and community initiatives in our overall ESG strategy and performance. Our Nominating and Corporate Governance Committee regularly reports to the Board on the ESG-related activities of the Board committees.

ESG OVERSIGHT BY OUR BOARD COMMITTEES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Synchrony Financial Board of Directors |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Nominating

& Corporate

Governance

Committee | | Audit

Committee | | Management,

Development &

Compensation

Committee | | Risk

Committee | | Technology

Committee | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| •Oversee ESG and corporate social responsibility •Oversee Synchrony’s corporate governance, including director qualifications, and board leadership and committee structure | | •Oversee Synchrony’s compliance with legal, ethical and regulatory requirements and related processes and programs, including our compliance and Ombuds programs | | •Oversee Synchrony’s human capital management, including policies and strategies for recruiting, retention, career development and progression, management succession for key executives, corporate culture, diversity, and employment practices | | •Oversee Synchrony’s enterprise-wide risk management framework, including as it relates to operational risks, which encompass cybersecurity, compliance, and business resilience risks | | •Review of Synchrony’s approach to technology-related innovation | |

You can read more about our ESG efforts in our ESG report at www.synchrony.com. Our ESG report is not, and will not be deemed to be, a part of this proxy statement or incorporated by reference into any of our other filings with the SEC.

14 / 2024 ANNUAL MEETING AND PROXY STATEMENT

STOCKHOLDER ENGAGEMENT

We continue to value our stockholders’ perspectives on our strategy and governance practices. We believe that maintaining a dialogue with our stockholders allows us to better understand and respond to their perspectives on matters of importance to them. As part of our regular stockholder engagement in 2023, we engaged with representatives of a majority of our outstanding shares on a variety of topics, including our growth plans, business strategy, board composition, compensation practices and ESG issues. We also hosted our first Investor Day in 2021 to provide stockholders and other stakeholders a deeper dive into our business model, long-term growth strategy and financial operating framework.

BOARD REFRESHMENT

Under the leadership of our Nominating and Corporate Governance Committee, Synchrony’s Board of Directors and its committees routinely evaluate our Board and Board committee composition and leadership, as well as our latest updated skills matrix. This established process helps to ensure that the Board has the requisite expertise to oversee Synchrony’s business today and as it evolves under our strategy for the future. As a result, since 2019, we have added four new directors, adding expertise in healthcare, digital, technology, the consumer sector and risk management in the consumer banking sector. As a group, our Board possesses expertise in areas directly relevant to our business and strategy—including accounting, consumer banking, credit cards, cyber security, government affairs, healthcare, marketing, retail, risk management, digital and technology. We also recently rotated the chairs of our Audit Committee, Management Development and Compensation Committee, and Nominating and Corporate Governance Committee.

CORPORATE GOVERNANCE PRACTICES

| | | | | |

OUR GOVERNANCE HIGHLIGHTS INCLUDE: |

| Nine out of 10 directors are independent |

| Experienced Board members with a diversity of skills and backgrounds |

| Five out of 10 directors are women and/or minorities |

| Three out of five Board committee chairs are women and/or minorities |

| Each of the Audit Committee, MDCC, Nominating and Corporate Governance Committee, Risk Committee

and Technology Committee is comprised exclusively of independent directors |

| Non-executive Chair of the Board |

| Regular meetings of independent directors in executive session without management |

| Annual election of all directors |

| Majority voting standard for directors in uncontested elections |

| Stockholder special meetings may be called upon the request of a majority of stockholders |

| Single-class voting structure (one share, one vote) |

| No stockholder rights plan |

| Stock ownership requirements for our executive officers and directors |

| Stockholder proxy access |

| Nominating and Corporate Governance Committee regularly reviews overall corporate governance

framework and oversees the Company’s ESG efforts |

2024 ANNUAL MEETING AND PROXY STATEMENT / 15

BOARD OF DIRECTORS

We believe that our directors possess the highest personal and professional ethics, deep industry knowledge and expertise, and are committed to representing the long-term interests of our stockholders. We deliberately and thoughtfully formed a Board with diverse perspectives and experiences, which we believe is critical to effective corporate governance and to achieving our strategic goals. Five of our 10 directors are women and/or minorities; nine are independent; three are women and three are considered members of minority groups. The composition of the Board reflects distinct and varied professional experience and cognitive diversity.

BOARD OF DIRECTORS DIVERSITY AND SKILLS MATRIX

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | FERNANDO

AGUIRRE | PAGET

ALVES | KAMILA

CHYTIL | ARTHUR

COVIELLO | BRIAN

DOUBLES | ROY

GUTHRIE | JEFFREY

NAYLOR | BILL

PARKER | LAUREL

RICHIE | ELLEN

ZANE |

| | | | | | | | | | | | | |

| GENDER DIVERSITY | | | | | | | | | | |

| MALE | ● | ● | | ● | ● | ● | ● | ● | | |

| FEMALE | | | ● | | | | | | ● | ● |

| ETHNIC DIVERSITY | | | | | | | | | | |

| BLACK OR AFRICAN AMERICAN | | ● | | | | | | | ● | |

| HISPANIC | ● | | | | | | | | | |

| WHITE/CAUCASIAN | | | ● | ● | ● | ● | ● | ● | | ● |

| | | FINANCIAL EXPERT | ● | ● | ● | ● | ● | ● | ● | | | ● |

| RISK EXPERT | | ● | | ● | ● | ● | ● | ● | | |

| FINANCIAL SERVICES INDUSTRY | | | ● | | ● | ● | ● | ● | | |

| C-SUITE EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| BRAND AND MARKETING | ● | | | | | | | | ● | |

| DIRECT CONSUMER/RETAILERS | ● | ● | ● | | | | ● | | ● | |

| GOVERNMENT/REGULATORY | ● | | | | ● | ● | | ● | | ● |

| HEALTHCARE | ● | | | | | | | | | ● |

| HUMAN CAPITAL/COMPENSATION | ● | | | | | ● | ● | | ● | ● |

| STRATEGIC PLANNING | ● | ● | | ● | ● | ● | ● | | ● | ● |

| TECH/DIGITAL/CYBER | | ● | ● | ● | | | | | | |

| | OTHER PUBLIC COMPANY BOARD | ● | ● | | ● | | ● | ● | | ● | ● |

16 / 2024 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DIVERSITY | | | DIRECTOR INDEPENDENCE | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 OF 10 ARE FEMALE | | 9 OF 10 ARE INDEPENDENT | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | DIRECTOR AGE | | | | |

| 3 OF 10 ARE MINORITIES | | AVERAGE AGE 64 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 5 OF 10 ARE FEMALE AND/OR MINORITIES | | 44 | 45-48 | 49 | 50-63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | |

| | | | | | | | | | | | | YEARS | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

BOARD QUALIFICATIONS | | | | | | | | |

| | | | COMMITTEE MEMBERSHIP |

| NAME | AGE | DIRECTOR

SINCE | INDEPENDENT | AUDIT | MDC | NCG | RISK | TECH |

Brian D. Doubles President and CEO of Synchrony Financial | 49 | 2021 | | | | | | |

Fernando Aguirre Former Chairman, President and CEO of Chiquita Brands International, Inc. | 66 | 2019 | | | ● | | | |

Paget L. Alves Former Chief Sales Officer of Sprint Corporation | 69 | 2015 | | | | ● | | |

Kamila Chytil Chief Operating Officer of DentaQuest LLC | 44 | 2022 | | ● | | | | ● |

Arthur W. Coviello, Jr. Former Executive Vice President of EMC Corporation; Former Executive Chairman of RSA Security, Inc. | 70 | 2015 | | | | | ● | |

Roy A. Guthrie Former CEO of Renovate America, Inc.; Former Executive Vice President and Chief Financial Officer of Discover Financial Services, Inc. | 70 | 2014 | | | | | | ● |

Jeffrey G. Naylor (Non-Executive Chair of the Board) Former CFO and Chief Administrative Officer of the TJX Companies, Inc. | 65 | 2014 | | ● | ● | | | |

P.W. “Bill” Parker Former Vice Chairman and Chief Risk Officer of U.S. Bancorp | 67 | 2020 | | | | ● | ● | |

Laurel J. Richie Former President of the Women’s National Basketball Association LLC | 65 | 2015 | | | | ● | | |

Ellen M. Zane Former President and CEO of Tufts Medical Center and Tufts Children’s Hospital | 72 | 2019 | | ● | ● | | | |

| | | | | | | | | | | |

| Committee chair | ● | Committee member |

2024 ANNUAL MEETING AND PROXY STATEMENT / 17

ITEM 1—ELECTION OF DIRECTORS

The Board consists of 10 directors: our President and CEO, Brian D. Doubles, and nine directors who are “independent” under the listing standards of the New York Stock Exchange (“NYSE”) and our own independence standards set forth in our Governance Principles. The independent directors are Fernando Aguirre, Paget L. Alves, Kamila Chytil, Arthur W. Coviello, Jr., Roy A. Guthrie, Jeffrey G. Naylor, Bill Parker, Laurel J. Richie and Ellen M. Zane (together, the “Independent Directors”). Under our Bylaws, our directors will be elected annually by a majority of votes cast in uncontested elections. As discussed under Committees of the Board of Directors below, our Nominating and Corporate Governance Committee is responsible for recommending to our Board, for its approval, the director nominees to be presented for stockholder approval at each annual meeting.

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

Each of the 10 director nominees (the “Director Nominees”) listed on the following pages is currently a director of the Company.

The following biographies describe the business experience of each Director Nominee. Following the biographical information for each Director Nominee, we have listed specific qualifications that the Board considered in determining whether to recommend that the director be nominated for election at the Annual Meeting.

If elected, each of the Director Nominees is expected to serve for a term of one year or until their successors are duly elected and qualified. The Board expects that each of the Director Nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the Director Nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute Director Nominees as the Board may nominate.

| | | | | | | | | | | |

| | | |

THE BOARD RECOMMENDS A VOTE FOR the following nominees for election as directors. | | | |

| | | |

18 / 2024 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | | | | | | | |

|

| BRIAN D. DOUBLES |

| PRESIDENT AND CHIEF EXECUTIVE OFFICER |

| |

| |

|

Mr. Doubles, 49, has been our CEO and a director since April 2021 and our President since May 2019. He has also been a member of the board of directors of Synchrony Bank (the “Bank”) since 2009. Mr. Doubles previously served as our Executive Vice President and CFO from February 2014 to April 2019. Prior to Synchrony’s founding, Mr. Doubles served in various roles of increasing responsibility and management at the General Electric Company (“GE”). Mr. Doubles is a member of the Business Roundtable and Bank Policy Institute. Mr. Doubles received a B.S. in Engineering from Michigan State University. We believe that Mr. Doubles should serve as a member of the Board due to his extensive experience in the retail finance business, his risk expertise, and the perspective he brings as our President and CEO. | |

|

|

2024 ANNUAL MEETING AND PROXY STATEMENT / 19

| | | | | | | | | | | | | | |

| | |

| | | | |

| | | | |

Mr. Aguirre, 66, has been a director since July 2019. He served as President and CEO of Chiquita Brands International, Inc. from January 2004 to October 2012 and also served as Chairman from May 2004 to October 2012. Prior to that, Mr. Aguirre held various global marketing and management roles at Procter & Gamble from 1980 to 2004. Mr. Aguirre is currently on the boards of directors of CVS Health, a publicly-traded American healthcare company that owns CVS Pharmacy, CVS Caremark, and Aetna; and Barry Callebaut, a publicly-traded company which is one of the world’s largest cocoa processors and chocolate manufacturers. He previously served on other boards including Aetna, Inc., Coca-Cola Enterprises, and Levi Strauss & Co. Mr. Aguirre is currently the Owner & CEO of the Erie SeaWolves Minor League Baseball team, the double AA affiliate of the Detroit Tigers. He also owns a minority stake in the Myrtle Beach Pelicans, a low A affiliate of the Chicago Cubs. A native of Mexico, Mr. Aguirre is a prominent figure in the Hispanic community, recognized as one of the 100 Influentials by Hispanic Business Magazine and honored with the Hispanic Heritage Leadership Award by the NFL. Mr. Aguirre received a B.S. from Southern Illinois University Edwardsville. We believe that Mr. Aguirre should serve as a member of the Board due to his significant knowledge and experience in the areas of leadership, strategy, digital marketing, branding, and communications, as well as his extensive experience as chair and CEO of a large publicly-traded company and as a director of other publicly-traded companies. | | Mr. Alves, 69, has been a director since November 2015 and was a non-voting Board observer from July 2015 to November 2015. He has also been a member of the Board of Directors of the Bank since January 2017. He served as Chief Sales Officer of Sprint Corporation, a wireless and wireline communications services provider, from January 2012 to September 2013 after serving as President of that company’s Business Markets Group from 2009 to 2012. Prior thereto, Mr. Alves held various positions at Sprint Corporation, including President, Sales and Distribution, from 2008 to 2009; President, South Region, from 2006 to 2008; Senior Vice President, Enterprise Markets, from 2005 to 2006; and President, Strategic Markets, from 2003 to 2005. Between 2002 and 2003, he served as President and Chief Operating Officer of Centennial Communications Corporation and from 2000 to 2001 served as President and CEO of PointOne Telecommunications, Inc. Mr. Alves currently serves on the boards of directors of Assurant, Inc., a publicly-traded global provider of risk management products and services; and Yum! Brands, Inc., a publicly-traded company that develops, operates, franchises, and licenses a system of quick-service restaurants. Mr. Alves also serves on two private company boards: Sorenson Communications (Chairman) and Ariel Alternatives. Mr. Alves served on the board of International Game Technology PLC, a manufacturer and distributor of microprocessor-based gaming and video lottery products and software systems from 2015 to 2020. He previously served on the boards of directors of GTECH Holdings Corporation from 2005 to 2006; Herman Miller, Inc. from 2008 to 2010; and International Game Technology Inc. from 2010 to 2015. In 2017 and 2021, Savoy magazine recognized Mr. Alves among Savoy’s Most Influential Black Corporate Directors. Mr. Alves received a B.S. in Industrial and Labor Relations and a J.D. from Cornell University. We believe that Mr. Alves should serve as a member of the Board due to his executive management and leadership experience, including leadership roles with technology companies, his extensive background in sales, his financial expertise and his experience with strategic and business development. He also has experience with strategic corporate transactions, including mergers and acquisitions. The Board has determined that Mr. Alves qualifies as an “audit committee financial expert” as defined in Item 407(d) (5) of Regulation S-K. |

20 / 2024 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | |

| | |

| | | | |

| | | | |

Ms. Chytil, 44, has been a director since April 2022. Ms. Chytil has been the Chief Operating Officer of DentaQuest LLC, a private equity backed oral healthcare company, since March 2021. From October 2019 to March 2021, she served as the Chief Operating Officer of MoneyGram International, a public crossborder P2P payments and money transfer company. From May 2016 to October 2019, she served as MoneyGram’s Chief Global Operations Officer, and from May 2015 to May 2016 as its Senior Vice President of Key Partnerships and Payments. From August 2004 to March 2015, Ms. Chytil held various positions of increasing responsibility at FIS, a Financial Technology (FinTech) corporation that offers a wide range of financial products and services. At FIS, she served in multiple risk management, analytics, and operational roles, including Senior Vice President and General Manager of Retail Payments, focusing on traditional financial services as well as retail and underbanked focused financial products. From January 2003 to August 2004, she served as a Business Analyst at Danka Office Imaging Company and from May 2000 to January 2003 she served as an Account Manager at Capital One Financial Corporation. Ms. Chytil served as a board member for MoneyGram Foundation from 2019 to 2021; MoneyGram Poland from 2016 to 2021; and MoneyGram Payment Systems, Inc. from 2017 to 2021. In 2020, Ms. Chytil contributed to multiple articles on digital transformation in Forbes FinTech. In 2016 she was voted Woman of the Year in Business, Poland; and in 2017, she was awarded the Dallas Business Journal 40 under 40 award and she was chosen by PaymentSource as 1 of 25 Most Influential Women in Payments. Ms. Chytil earned a B.S. in International Business and Finance from the University of Tampa and an M.B.A. from the University of Florida. We believe that Ms. Chytil should serve as a member of the Board due to her executive management and leadership experience, and her extensive background in consumer finance, technology and operations. The Board has determined that Ms. Chytil qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. | | Mr. Coviello, 70, has been a director since November 2015 and was a non-voting Board observer from July 2015 to November 2015. He has also been a member of the Board of Directors of the Bank since January 2017. Since 2015, he has been an independent cybersecurity consultant and since August 2022 has served as a Managing Partner of SYN Ventures, a venture capital firm specializing in investing in cybersecurity companies. He served as Executive Vice President of EMC Corporation, an IT infrastructure company, and Executive Chairman of RSA Security, Inc. (“RSA”), the Security Division of EMC Corporation and a provider of security, risk and compliance solutions, from 2011 to 2015, after serving as Executive Vice President and President of RSA from 2006 to 2011. Prior thereto, Mr. Coviello held various executive positions at RSA, including President and CEO from 2000 to 2006, and President from 1999 to 2000. Prior to RSA, he had extensive financial and operating management expertise in several technology companies. Mr. Coviello currently serves on the boards of directors of Tenable Holdings, Inc., a publicly-traded provider of Cyber Exposure solutions, which is a discipline for managing and measuring cyber security risk; and three private software companies, Oomnitza, Inc., Phosphorous Security Inc, and RegScale, Inc. Mr. Coviello previously served on the boards of directors of several public companies: Epiphany Technology Acquisition Corp., Mandiant, Inc., EnerNOC, Inc., and Gigamon, Inc. He received a B.B.A. in Accounting from the University of Massachusetts, Amherst. We believe that Mr. Coviello should serve as a member of the Board due to his leadership experience, including as CEO of a publicly-traded company, his extensive financial expertise and accounting background and his considerable experience in technology and cybersecurity. |

2024 ANNUAL MEETING AND PROXY STATEMENT / 21

| | | | | | | | | | | | | | |

| | |

| | | | |

| | | | |